How does UIF payment verification prevent fraudulent claims? The Unemployment Insurance Fund (UIF) has introduced a UIF payment verification process aimed at fighting fraud regarding UIF claims.

But how does this UIF payment verification prevent fraud?

How Does UIF Payment Verification Prevent Fraudulent Claims?

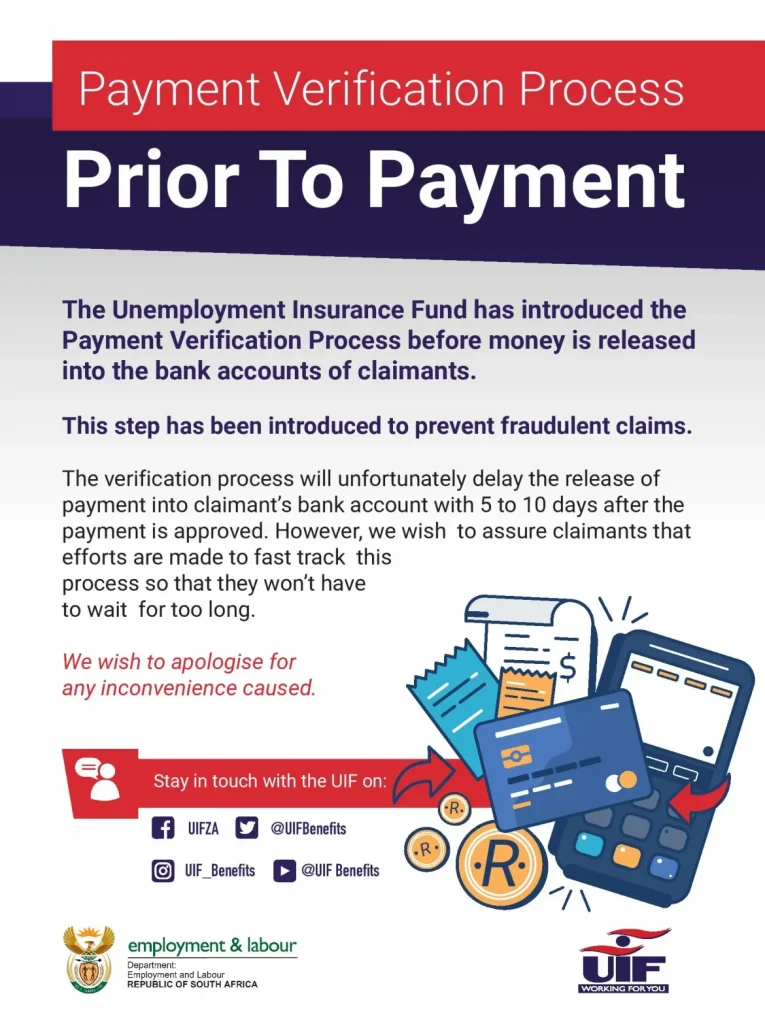

According to the Unemployment Insurance Fund (UIF), there have been lots of UIF Benefit Claims and to avoid these fraudulent activities against the Department of Labour, they will henceforth, process all claims through a verification process.

Again, the verification process will help to check if the employee claiming his or her UIF benefits qualifies to claim his UIF money.

Also, the UIF payment verification process will help to make sure the employee is registered to contribute to UIF and that he or she has been paying his or her UIF contribution until he or she became unemployed.

Moreover, the UIF payment verification process will make payment of money into the claimant’s bank account delayed for at least 5-10 days.

This period allows the Department of Labour in charge of the Unemployment Insurance Fund (UIF) makes all the necessary checks to validate the credibility of the UIF claimant.

We do recommend that you read How Does UIF Payment Verification Process Work? for detailed information on how the payment verification process of UIF works.

Does Employees Fraud UIF With Benefit Claims?

Yes, according to the Department of Labour via the Unemployment Insurance Fund (UIF), people try to claim UIF benefits when they do not qualify for the money.

This is the main reason why they have introduced the UIF payment verification process. To do all the necessary checks against claims before they pay the money into the claimant’s account.

You should read How Do I Know I Qualify For UIF Benefits? for all the qualifications you need to meet before you claim your UIF benefits.

We do hope this article on how UIF payment verification prevents fraudulent claims was helpful.

You can ask your question in the comment.